AccessFlow's Unified Operations Management Platform

Driving Security, Compliance, and Efficiency in the Banking & Finance Industry

The Banking industry faces a fast-evolving landscape where regulatory compliance, security, and innovation are crucial for competitiveness. As digital transformation accelerates, financial institutions must adopt new technologies, meet rising customer expectations, and manage security risks—all while overseeing a dispersed workforce. AccessFlow's Unified Operations Management Platform tackles these challenges by automating processes, ensuring compliance, and improving efficiency.

Key Challenges for Banking & Finance Industry Providers

Since the 2008 financial crisis, regulatory fees and compliance requirements have surged. Navigating complex regulations like GDPR, AML, and KYC, while controlling compliance costs, is a major challenge for banks and credit unions.

Younger generations expect seamless, digital banking experiences. To meet these expectations, financial institutions must offer a streamlined, intuitive customer journey backed by advanced technology.

High-profile security breaches have increased concerns about data protection in banking. Financial institutions face ongoing pressure to secure sensitive data and protect both customer information and internal systems from cyber threats.

Legacy systems and siloed operations hinder digital transformation. Financial institutions relying on outdated applications struggle to meet the demand for real-time information, data integration, and innovative services.

Analysing customer behaviour and acting on insights is crucial for competitiveness. Without the ability to adapt and innovate, financial institutions risk failing to meet customer expectations and market demands.

Managing large, dispersed teams across regions, ensuring compliance with regulations and security protocols, remains a persistent challenge. Streamlined processes for workforce coordination, credential verification, and compliance tracking are essential to prevent operational disruptions

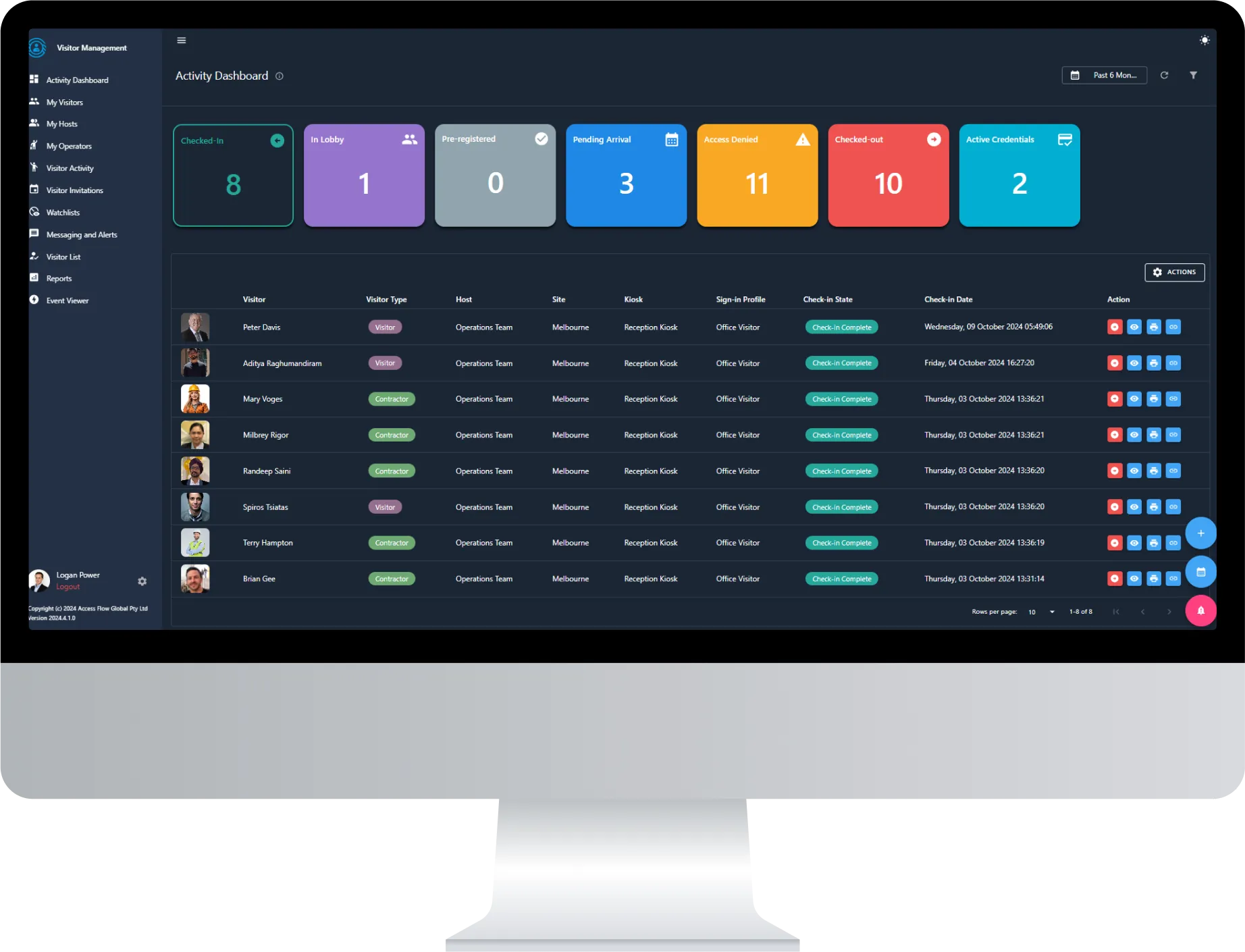

AccessFlow's Solution

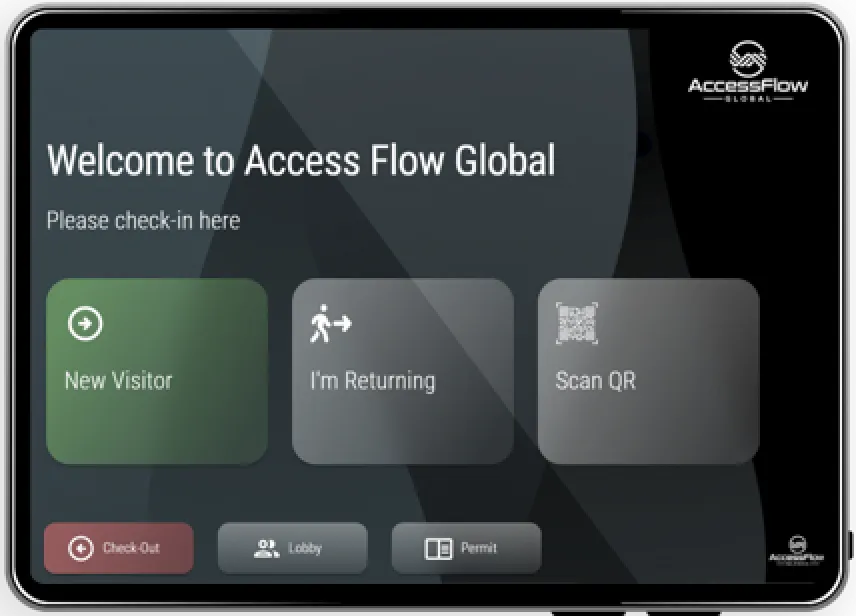

AccessFlow's Unified Operations Management Platform offers a comprehensive platform to address these specific challenges.AccessFlow empowers financial institutions to stay ahead of the curve in a competitive and highly regulated industry by automatingregulatory compliance, improving security, and facilitating digital transformation.

Benefits of AccessFlow for Banking & Finance

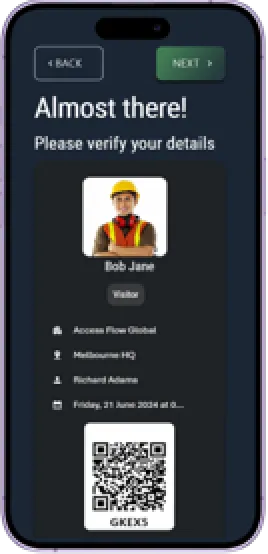

Secure, role-based access control ensures only authorised personnel can access critical data, systems, and physical locations, protecting against potential breaches.

Tools to manage risk assessments, enforce policy adherence, and streamline audit reporting, ensuring compliance with evolving regulations such as AML, KYC, and data protection laws.

Automates scheduling, compliance tracking, and real-time monitoring of staff and contractors, ensuring efficient coordination of large teams across multiple locations.

Seamless integration with existing banking systems and customer management platforms unifies operations, eliminates siloed applications, and improves overall efficiency.